At the end of an invigorating but overwhelming day of discussing competitive intelligence, I often hear people ask for simplicity.

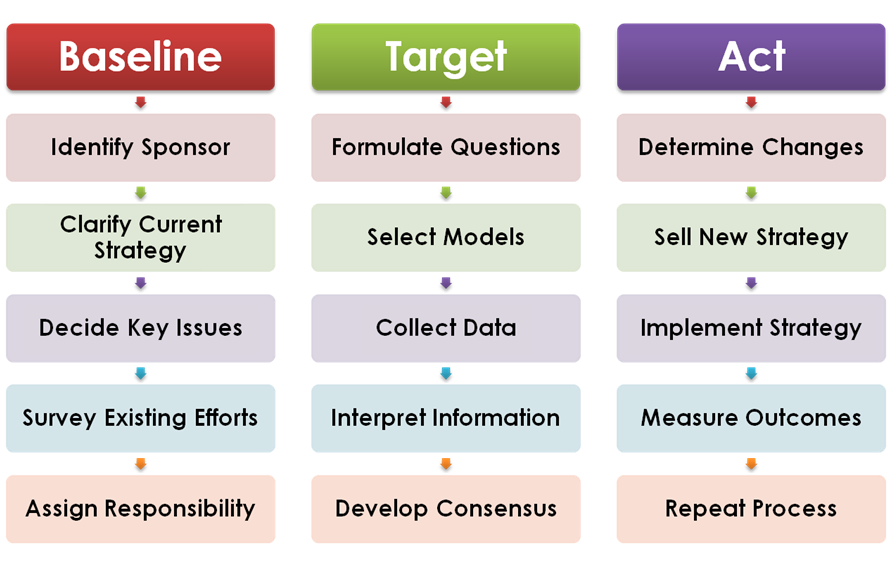

As I wrote about in “The Three Basic Competitive Intelligence Questions”, the simple formulation of “What? So What? Now What?” regularly resonates. People tell me that they finally understand competitive intelligence after internalizing those three questions. While that is encouraging, the questions are a framework with only the hints of specific actions.

“Just tell us what to do,” they say. “You’ve convinced us that competitive intelligence is important and that there is a lot to know about doing it right. Give us a three step approach that we can wrap our arms around and remember. We want something tangible to do!” they demand.

“Okay, okay, I’ll give you some steps,” I say. (Unsurprisingly, these steps correlate to the three questions in the framework.)

Here are three tangible steps that most anyone can take to get moving. If these issues are well covered, then there is a good start at competitive intelligence. Furthermore, after one pass through these steps, a company will understand competitive intelligence far better than most any simple formulation.

1. Make Sure You Know Where You Are and Where You Want to Go: It is surprising how many companies cannot articulate their strategy. Or, if senior management can locate the strategy statement, it is common to find that many others are misunderstanding or misapplying the strategy. Strategy helps an organization understand its direction. And, at least with competitive intelligence, it is a critical point of comparison with the competitive forces in the environment. A poorly understood strategy baseline means that an unmanageable number of factors must be considered. Conversely, a clear strategy narrows the focus into something workable.

2. Aim At Something Valuable: I often hear of companies collecting gobs of information that goes unused. Sometimes, that unused information contains incredible value. The problem is often that no one posed the right question at the beginning. The “right” question has attributes of value to strategy decision-makers, answerable in the needed time with acceptable risk and potential to drive change. Poor questions, on the other hand, yield unused answers.

3. Do Something With the Good Answers: There should be a high bar for competitive intelligence that affects strategy. Quantity of data is not enough. Quality is not either if it is misdirected. However, a “good” answer cannot be ignored when it is the result of a methodical, targeted competitive intelligence process. Hence, from the beginning of the effort, there must be an implementation mindset activated by a good answer. “Activation” means that it changes strategy in a way that, ultimately, is measureable. I like to ask this question, “Assuming that I could provide an answer with acceptable risk, how would you use that information in your strategy decisions?” When a customer cannot answer that question, it points to a potential failure point.

There is an incredible amount of detail for each of these three steps. A mature competitive intelligence group knows to do much more than I have listed. However, for companies or work groups that are just starting, three simple steps will work well for them to gain experience and get something valuable. The goal is not to be perfect. Rather, the goal is to actively make better strategies through competitive intelligence.

They simply need to “just do it.”

[…] This post was mentioned on Twitter by Tom Hawes, August Jackson. August Jackson said: RT @JTHawes: Wrote "Competitive Intelligence's Just Do Its" to give steps for companies to get started – http://tinyurl.com/2d3hfbh . […]

Tom,

The term “competitive intelligence” is so fuzzy and unfamiliar to most business people that we need MANY ways to describe and define it. And yours add clarity and specificity.

Hopefully, one or two will resonate so that CI becomes a valued addition to the business arsenal.

Of course, I like my definition in my book but I absolutely recognize the need for many definitions.

Seena Sharp

Author, Competitive Intelligence Advantage

Seena,

Thanks for your comment. Aside from the SCIP definition that I use for a “formal” definition (not arguing that it is the best or only one), I try to find explanations that make the most sense to a particular audience. What good does it do me to have an elegant description that only pleases me but does not connect with my customer/client? My experience says – not much. People are incredibly activated and interested when they feel like they get it. My job is to make that easier.

Tom