A small-to-medium size business (SMB) is different from a large corporation in many ways (I don’t think that I am breaking any news by this statement). An SMB views the world differently.

A small-to-medium size business (SMB) is different from a large corporation in many ways (I don’t think that I am breaking any news by this statement). An SMB views the world differently.

Aside from the obvious facts that an SMB has smaller revenues, fewer people and (probably) a narrow product or service scope, there are other less obvious differences in strategy issues. Here are a five common strategy differences.

- Strategy Responsibility: The responsibility for strategy is often shared among a small number of senior managers rather than vested in a named function (e.g., vice president of strategy). It is a part-time, diffuse task.

- Strategy Definition: The company completes few formal strategy exercises. Emergent strategy is assigned much greater value. That is, strategy is “recognized” rather than prescribed.

- Decision-Making: Decision-making speed is valued over reflection. Rapid adaptation and reaction are the currency of the day.

- Tactical Activities: Day-to-day pursuit of customers, creating products, closing deals and operations consumes management’s time. In short, tactics dominate strategy.

- Internal Focus: Attention to the external environment is narrowed to match the SMBs near-term customers and prospects. There is less attention paid to broad trends, unexpected competitive threats and tangent opportunities.

All right, what about the SMBs that do think that strategy and competitive intelligence are (or might be) important? What is a feasible set of practices for them to initiate and sustain over time? For whatever stage of strategy and competitive intelligence maturity they find themselves, how do they move to the next stage?

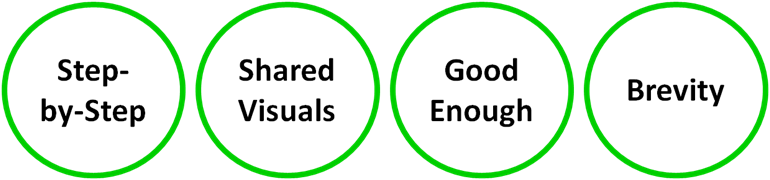

Before talking about the stages, there are four meta-principles for SMB competitive intelligence practices.

I. Use a constrained, systematic development of competitive intelligence to support strategy decisions.

Why constrained – simply because every SMB deals with resource limitations. Typically, money is tight and management attention is precious. The systematic approach identifies the important fundamentals and suggests an order for their development. Do certain things first and move to the next steps when you are ready is the key. Add to the ordered steps a sense of accountability. Accountability sets the bar for competitive intelligence to affecting important strategy decisions. Otherwise, why do it when there are so many other things to do?

II. Employ the power of a shared visual focus.

“Shared visual focus” means that it is incredibly useful to capture important thoughts in a manner that they can be seen and shared by many people. Then, those people have the chance to challenge, improve and adopt the ideas. This is essential for an SMB since there is a high cost for inefficient strategy. Many times the strategy inefficiencies could have been avoided with simple communication approaches.

III. Avoid the perfection standard.

It is admirable to have high standards until those standards prevent you from starting something important. For instance, if you need “perfect” intelligence and nothing else will do, you are unlikely to get started when intelligence will only be “good.” An SMB might want to know everything, to never make a mistake and to eliminate all risk. These are lofty aspirations but the vast majority of competitive intelligence will fall short. It is far better to start moving with something “good enough” so that you can get to the “improving” part sooner.

IV. Be succinct.

Verbosity is not a virtue for an SMB.

In fact, an SMB seldom uses “heavy” processes (when there is a choice) or exhaustive documentation. These are luxuries (burdens?) that cost too much and deliver too little value. Instead, a short, to-the-point summary of critical information is preferred. Hence, when I talk about specific competitive intelligence practices, each can be done by hand (i.e., requires no tools or automation) and completely represented on a single sheet of paper. Ideally, a wall or whiteboard can hold all of the competitive intelligence information derived from the practices.

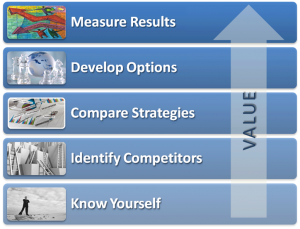

Five Practice Stages of Competitive Intelligence for SMBs

If you are already doing the first one or two steps, move to the next higher step to receive more value from competitive intelligence.

Step 1: Know Yourself

Perhaps this is an odd way to start thinking about competitive intelligence. After all, is not competitive intelligence about the environment? Are we not supposed to look at our competitors? The answer is “yes” to both of those questions. However, an SMB will soon discover that much competitive intelligence is relative. That is, the way to interpret the environment depends, in part, on comparison to a fixed position. For an SMB, the fixed position is their company. To the extent that the company, its vision, capabilities, plans, products, etc., are well understood, better lessons can be drawn about the environment and competitors.

Here are five questions to answer that will help an SMP “know itself.” (Remember that the answer to each question should require no more than one page.)

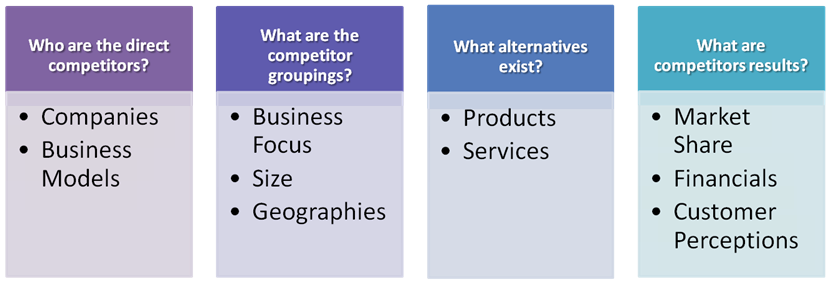

Step 2: Identify Competitors

There are two negative answers to “who are your competitors?” One negative, usually unhelpful answer is to say that there are no competitors. The other negative answer is “I don’t know.” On the other hand, it is extremely positive to know how customers contemplate spending their money when they decide not to buy your products or services. The customer makes a financial choice that affects the SMB directly and knowing why can lead to changing a future customer decision. An SMB should start with their direct competitors. A direct competitor sells a similar product or service. “Alternatives” or substitutes are a little less obvious. They are choices that can be made instead of a product or service. For instance, two airlines are direct competitors. However, video conferencing over the internet to connect friends and family may obviate the need for travel for some people. Create one page for each of the following.

Step 3: Compare Strategies

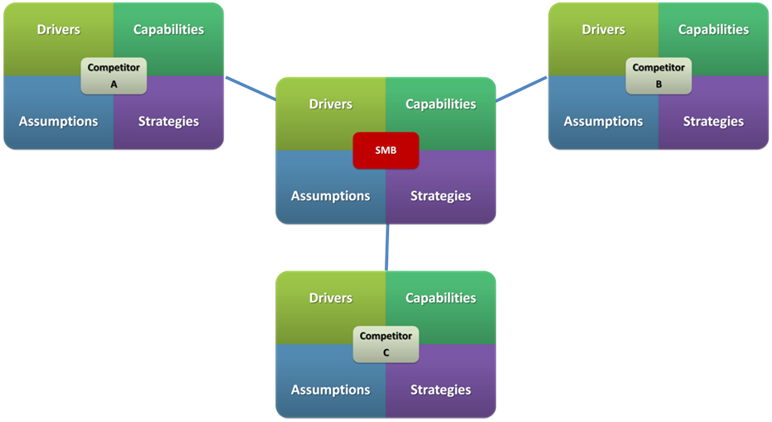

One of the three fundamental competitive intelligence questions is “so what?” (The other two questions are “what?” and “now what?”) That is, having answered (at least partially) the “what is happening?” question, it is critical to move to the meaning of what is happening. Interpretation lays the groundwork for action (see the next step). One type of interpretation deals with the strategies of competitors and an in-depth comparison with the SMB’s strategies. Here is what you do. Pick the most important competitors that represent the biggest threats to your success. For each competitor, complete a one-page summary of their strategy that covers four points. Do the same for your company. Review the strategy descriptions with the results from Step 2. This exercise helps refine the SMB’s value proposition and competitive positioning. It sets the stage for deciding what to do (better).

One of the three fundamental competitive intelligence questions is “so what?” (The other two questions are “what?” and “now what?”) That is, having answered (at least partially) the “what is happening?” question, it is critical to move to the meaning of what is happening. Interpretation lays the groundwork for action (see the next step). One type of interpretation deals with the strategies of competitors and an in-depth comparison with the SMB’s strategies. Here is what you do. Pick the most important competitors that represent the biggest threats to your success. For each competitor, complete a one-page summary of their strategy that covers four points. Do the same for your company. Review the strategy descriptions with the results from Step 2. This exercise helps refine the SMB’s value proposition and competitive positioning. It sets the stage for deciding what to do (better).

- Drivers: What are the goals, values and needs of the company?

- Assumptions: What does the company assume to be true about the industry, competition and its own capabilities?

- Capabilities: What resources, assets and talents does the company possess to allow it to win?

- Strategies: How is a company actually competing to win?

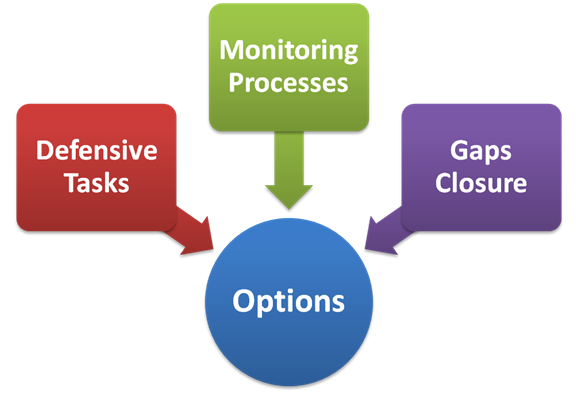

Step 4: Develop Options

Understanding leads to options. Options are the basis for decisions and good competitive intelligence is a key foundation for a variety of decisions. In fact, though competitive intelligence may not be a separate function or a named assignment, it is hard to imagine an important decision being made without competitive intelligence (even if it is the ad hoc type). While there are many kinds of decisions, three types are particularly important.

Understanding leads to options. Options are the basis for decisions and good competitive intelligence is a key foundation for a variety of decisions. In fact, though competitive intelligence may not be a separate function or a named assignment, it is hard to imagine an important decision being made without competitive intelligence (even if it is the ad hoc type). While there are many kinds of decisions, three types are particularly important.

- Defensive Tasks: The comparative nature of competitive intelligence helps the SMB to understand both its competitors’ value and its own value. The latter realization makes clear what assets need protection. An SMB needs to know explicitly what to protect and how to protect it. There are many protection methods and each incurs costs. Thus, an SMB needs to choose the right methods to protect what is most valuable.

- Monitoring: Some SMBs are satisfied with a competitive intelligence snapshot. While this may be valuable, it relevancy diminishes as changes occur in the environment. It is better to think in terms of an ongoing competitive intelligence “video.” A video captures the story and the changes. Investing in monitoring need not be expensive. Simple methods exist to watch for key competitive events. An SMB needs to decide what to watch for, when to make observations and how to review it over time.

- Gaps Closure: Sometimes an SMB leads, sometimes it follows. “Following” implies that one or more competitors have distinct advantages. For instance, the competitive products may be cheaper, more powerful, easier to use, etc. These advantages are “gaps.” An SMB needs to know which gaps are significant barriers to its success. That knowledge is the basis for intentionally devoting resources to close the gap. Competitive intelligence provides excellent insight into identifying gaps, their significance and the priorities for their closure.

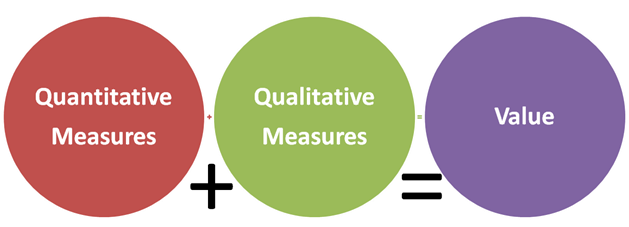

Step 5: Measure Results

There are two categories of results attributed to effective competitive intelligence. First, there are quantitative financial results. For instance, revenues, profits or market share may increase due to competitive intelligence insights. Though this is an excellent  outcome, it is sometimes an elusive goal to attribute all such improvements to a specific competitive intelligence insight. After all, even when competitive intelligence improves a strategic decision, there are many operational issues to resolve to realize the benefit of the insight. A second measure is qualitative. Has competitive intelligence improved the decision-making confidence of senior management? Did the competitive intelligence decrease important execution or resource allocation risks? How did focused competitive intelligence efforts improve the strategic alignment within the SMB? A positive answer for any of these questions is an endorsement for the value of competitive intelligence.

outcome, it is sometimes an elusive goal to attribute all such improvements to a specific competitive intelligence insight. After all, even when competitive intelligence improves a strategic decision, there are many operational issues to resolve to realize the benefit of the insight. A second measure is qualitative. Has competitive intelligence improved the decision-making confidence of senior management? Did the competitive intelligence decrease important execution or resource allocation risks? How did focused competitive intelligence efforts improve the strategic alignment within the SMB? A positive answer for any of these questions is an endorsement for the value of competitive intelligence.

Conclusion

There you have it – an ordered set of competitive intelligence practices for an SMB. Doing all of them at once is a mistake when an SMB is beginning its competitive intelligence efforts. Start from a foundation and build up. Make sure that everyone in the company is aware. Evaluate the success by how competitive intelligence affects important decisions. And, whatever else you do, get started. If you do not, know that your competitors may be ahead of you because of the insights that they have gained.

Took some notes, Great read!