Selling strategy and strategic thinking to a trial-and-error management team can make perfect sense. In fact, it not only makes perfect sense but it is a complementary antidote to inevitable blind spots of the most intuitive of people. Properly executed, a thorough strategy process balances perspectives to reduce the possibility of missing something important. Indeed, systematically eliminating unknowns (or, better, converting assumptions to facts) is an important cornerstone to discovery driven growth.

Eskimos, as the saying implies, are not the best customers for snow makers. Obviously, given where they live, snow and ice exist in abundance. Producing something that is already free seems unlikely to induce someone to make an incremental investment. Yet, an Eskimo depends on the ice and snow for traditional igloos and, perhaps more importantly, for maintaining an environment that supports their lifestyle. It is a hedge, maybe, to pay for something that often appears unneeded. However, the moment the temperatures rise, that hedge is all that stands between disaster and survival.

Strategy is similar. Most management teams get by on undirected intuition. They already “own” this and everyone has an opinion to assert. Sometimes, it works spectacularly well. After all, business owners and senior managers tend to be smart, experienced people. Other times, increased competition or environmental changes expose a lack of strategic problem solving. When that happens, business results suffer.

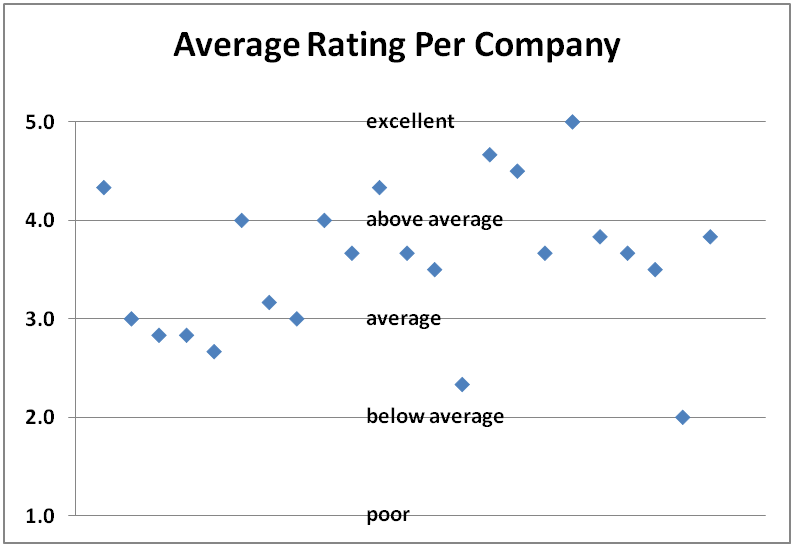

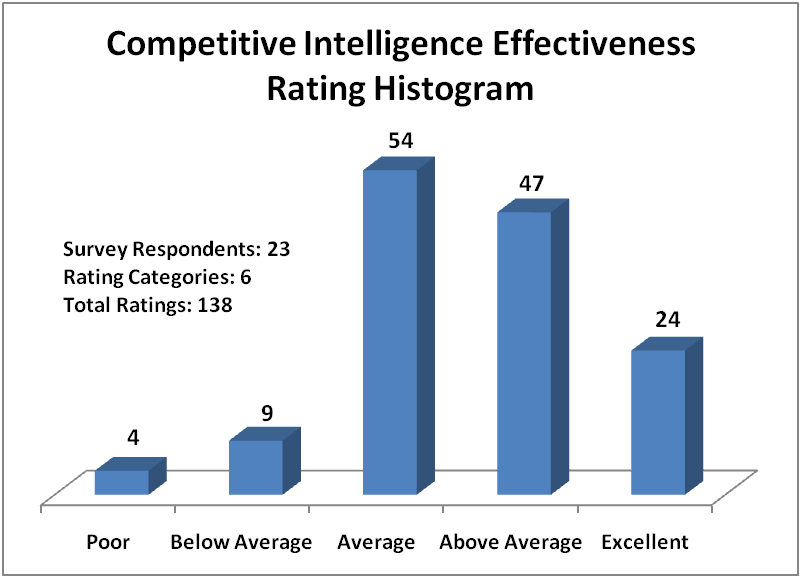

Recently, with Don Springer of the The Colton Group, I completed a survey of 22 business leaders of small-to-medium size businesses. Most of these businesses involve technology products and services. The demographics from the survey are shown in the following graphics.

Read the rest of this entry